Implementation of Company Due Diligence in 2020

Too often, the process of due diligence is considered as trouble or impediment that must be encountered. This misconception overlooks the privilege that a corporate due diligence process actually provides. To explain the importance of due diligence, let’s take a step back and consider what due diligence is and how the whole process goes.

What Is Due Diligence?

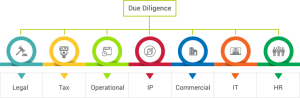

Due diligence is the process of conducting an audit or investigation in order to examine the activities of a company prior to its acquisition, public listing, restructuring, refinancing, disposal, or other similar transactions. The intention behind carrying out a due diligence process is to enhance an investor’s understanding of the important information pertaining to corporate transactions which allows the party to make informed investment decisions. Now, let’s have a look at its different types.

1. Legal Due Diligence

Legal due diligence establishes if there are any legal issues involved while buying or investing in a business. Some of the important legal documents of the target firm, such as employment contracts, board meeting minutes, memorandum and articles of association, patents, copyrights, or any other property related documents, are reviewed by a legal practitioner while carrying out the process.

2. Tax Due Diligence

Tax due diligence makes sure that the seller’s firm does not possess any past tax liabilities which might have been materialized because of some mistakes or deception which could later be passed on to the acquiring firm.

3. Operational Due Diligence

Operational due diligence (ODD) provides a complete analysis of the operational features of the target company during mergers and acquisitions to the eventual buyer. An ODD reviews the main operations of the targeted company and tries to confirm whether the business plan that has been provided is achievable with the existing operational facilities along with the capital expenditure which has been outlined in the business plan.

4. Intellectual Property Due Diligence

Intellectual property due diligence examines the various rights the company may have in various intellectual properties, such as patent, copyright, trademark, etc., that the company may own.

5. Commercial Due Diligence

Commercial due diligence aims at gaining an understanding of the market in which the target company operates by analyzing the forecast of the future market growth and also interacts with the customers of the business in order to fetch their opinions about the business.

6. Information Technology Due Diligence

Information technology due diligence aims at identifying whether or not there is any information technology in the target entity. Matters such as scalability of systems, robustness of processes, level of process documentation, compliance with the legislation, and ability to integrate different systems, is taken care by IT due diligence.

7. Human Resource Due Diligence

Human resource due diligence understands the impact of human capital on the deal that has been proposed. The employment records, compensation schemes, HR processes, ongoing HR litigations, and the effectiveness of sales force and cultural factors, are some of the aspects that are taken care of by the HR due diligence.

Documents Required in Company Due Diligence

While performing a due diligence on a company, it is the responsibility of the seller of the business to provide all the necessary documentation and information which are mandatory for carrying out a due diligence process. If you are wondering what the documents are required for due diligence, here’s the list:

- Memorandum of Association

- Articles of Association

- Certificate of Incorporation

- Shareholding Pattern

- Bank Statements

- Financial Statements

- Income Tax Returns

- Tax Registration Certificates

- Tax Payment Receipts

- Statutory Registers

- Property Documents

- Intellectual Property Registration or Application Documents

- Utility Bills

- Employee Records

Operational Records

Procedure of Carrying Out a Due Diligence

The due diligence of a company is generally performed before a business sale, private equity investment, or bank loan funding. In the due diligence process, the financial, legal and compliance functions of the company are carefully reviewed and documented. A step-by-step guide explaining the process of due diligence is as follows:

- Understand compliance concerns

- Define corporate objectives for due diligence

- Gather key information

- Screen prospective third-parties against watch lists

- Conduct a risk assessment

- Validate the information collected

- Record the due diligence process

- Establish a monitoring plan

- Review the due diligence process regularly

Due Diligence Checklist

Here’s a checklist of the documents that might come in handy while conducting a due diligence:

- Income statements

- Records of accounts payables and receivables

- Balance sheets and tax returns including business activity statements (last 3-5 years)

- Profit and loss records (last 2-3 years)

- Cash deposit and payment records, as reconciled with the accounts

- Utility accounts

- Bank loans and lines or letters of credit

- Minutes of directors’ meetings/management meetings

- Audit work paper files

- The seller’s claims about their business

- Privacy details

- Details about plant, equipment, fixtures and vehicles

- Intellectual assets of the business

- Existing contracts with clients/staff

- Partnership agreements

- Lease arrangements

- Details of the company’s automated financial systems

- Details of credit and historical searches related to the business

In light of the functions and stakeholders it serves, due diligence assumes a key role in the lifecycle of any business. We at JAXA can help you with due diligence services in Dubai and the rest of the UAE. For any other information on query on due diligence in the UAE, contact us – we’d be happy to help.