It is very important for a business to keep track of all its transactions. This can be done by utilizing proper Bookkeeping practices. Proficient bookkeeping practices help a company to conduct all business activities in a proper manner and also helps them in conducting an Audit of the company. Bookkeeping services allow the management to properly record all the transactions of the business but also help the management to gain knowledge about the inner workings of the company and prepare a future path for it.

Having accurate records will help in increasing the cash flow of the company and also provides help to the management in the process of making any financial decisions. We have seen a steady rise in the number of companies coming to the UAE and setting up a business and this has led to a rise in the demand for Accounting Services and Bookkeeping Services. This means that the scope and opportunities in the field of Bookkeeping and Accounting have increased drastically.

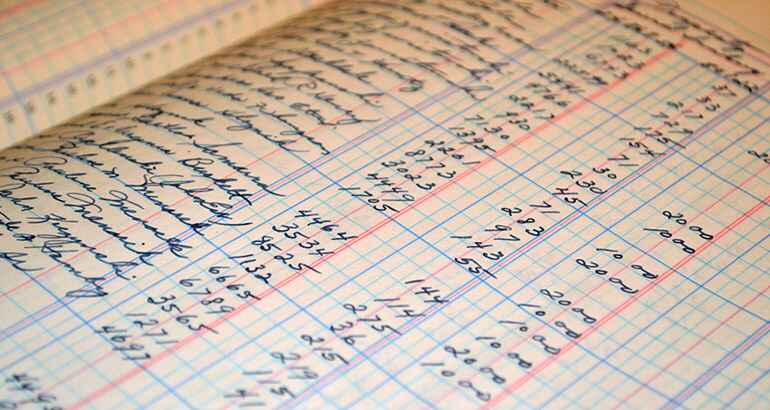

What is Bookkeeping?

Bookkeeping can be considered as a process in which all the transactions and other financial activities of the business are recorded. Special emphasis on “Recording” is given and this process does not include the analysis of the records.

The term Accounting and Bookkeeping are often substituted as they seem similar to the uninitiated, but this is not the case. Bookkeeping is actually a part of the Accounting process and includes only recording of all the financial transactions, whereas Accounting comprises scrutinising and presenting the data as received as a result of the Bookkeeping process.

It is in a business’s best interest to use both these activities together as it would give a better result in understanding the overall position of the business. Being a businessman it becomes essential for you to understand the best practices that you need to implement in your company.

Best Practices of Bookkeeping

In order to be profitable, a company should follow some best practices as these will help in the proper collection of the transactional data of the business. Some of the best practices of bookkeeping are mentioned below:

-

Keep Business Expenses and Personal Expenses Separate

If you have the same bank account for personal and business accounts, it can cause you a lot of problems. It becomes very time taking to find out your deductible expenses for the company and can be very confusing for you. Having dedicated accounts will enable you to understand the cash flow of the business and will make the process of budgeting less stressful.

-

Planning for the Future

Bookkeeping allows the management to prepare for the future. It provides a detailed list of all the transactions which would not only help in understanding the financial picture of the business but will also help in understanding the business environment better. Furthermore, it will be helpful in any mergers and acquisitions in the near future.

-

Track Every Business Expense

Tracking every expense would help in segregating the taxable transactions from the non-taxable ones. This would lessen the time taken at the end of the financial year or when we are filing for taxes.

-

Take Professional Assistance

Hiring a professional may sound like an extravagant idea, but it can save you a lot of trouble. When there are numerous transactions conducted by the business, an experienced professional can help the management in keeping track of all these transactions without any mistake. This may not sound like a big deal but missing even one transaction may spell doom for the business. An experienced professional will have a better knowledge of the loopholes in the tax law or any additional tax deductions which will come in handy.

-

Self – Audit is very Important

Keeping a daily record of all the transactions will help in creating a picture of the financial health of the company. This would assist in reviewing our decisions for the business and will also allow the management to take any corrective action if necessary. Keeping proper records of these transactions would also help at the time of an internal audit of the company.

-

Use a Bookkeeping Software

The use of the software would automate most of the time-intensive and monotonous tasks of Bookkeeping and Accounting. This accounting software can also be easily and quickly updated with any new rule specific to a particular region or jurisdiction. The use of software can make life very easy for the business owner.

-

Give Details

This is usually not done in businesses but having an appropriate description of the inventory helps in preventing misplacement or theft of the product. These details will also assist in gauging how useful the product is and the trend in the market.

-

Use Online Banking

Advancements in technology have been beneficial in businesses also. Now, you can do your banking transactions online without the hassle of going to the banks and standing in line. Online banking will also help you in generating reports in real-time which would give you the current picture of the business transactions. You can even integrate your online banking account with your accounting software which would automatically and accurately record all the data.

These are some of the steps which, if followed by you, will give you a keep your business working without any hitch and would assist in its growth and development.

Bookkeeping and accounting may seem like a small task, but it has a significant impact on the present and future of the business. It is because of this reason it is suggested that you acquire the services of a professional. Accounting outsourcing services provide you with professional expertise and will allow you to focus more on the business. If you are looking for such services, JAXA Chartered Accountants is here to assist you.

We at JAXA, understand your business and aim to deliver customised solutions which will most suit your business needs. Our business experts help in building specific plans to enhance your business growth. To know further about the other services provided by us, do contact us – we’d be happy to assist.