The UAE Ministry of Finance (MoF) and the Federal Tax Authority (FTA) had issued an announcement offering penalty relief to taxpayers who missed the corporate tax registration deadline. This initiative enables eligible taxable businesses and certain exempt entities that failed to register for corporate tax in the UAE before the stipulated deadline.

The AED 10,000 corporate tax registration penalty will be waived where the first corporate tax return are filled within seven months from the end of the first tax period. This update is advantageous for businesses that missed the UAE corporate tax registration deadline while maintaining compliance with their filing obligations.

Navigating corporate tax registration, penalty waiver, and filing timeliness demands careful attention to UAE FTA regulations. With Jaxa’s position as UAE FTA tax agent and best corporate tax consultant, companies can assess eligibility and secure penalty waiver relief with confidence while staying in compliance with UAE corporate tax.

What is the late corporate tax registration penalty waiver in the UAE?

The UAE corporate tax penalty waiver is a one-time compliance relief for first-time corporate tax return filers introduced by the FTA in April 2025, allowing eligible businesses to obtain a waiver of the late registration penalty provided the required filing timelines are met.

The primary condition for availing a waiver is simple: the business must submit its UAE corporate tax return within seven months from the end of its First tax period. The late registration penalty is waived if the filing is completed within this window. If the penalty has already been settled, an eligible business may request a refund through the Emarartax portal.

Example

If your first corporate tax period ends on 31st December 2025, you must submit your corporate tax return by 31st July 2026 to qualify for the penalty waiver. Filing within this seven-month window ensures that the AED 10000 late registration penalty is waived. Any submission made after 31st July 2026 will be ineligible for a waiver.

Entities Eligible for the UAE Corporate Tax Penalty Waiver

The UAE corporate tax penalty waiver extends to multiple categories of business and entities operating across the UAE as per UAE FTA regulations. Eligibility for the penalty waiver can be checked if they fall under any of the following:

- UAE taxable persons, including natural persons, limited liability companies, private entities, and other registered businesses

- Exempt entities, such as public benefit organisations and qualifying investment or pension funds

- Free Zone companies earning qualifying income and meeting economic substance and compliance requirements

- Mainland companies holding a valid UAE trade licence

- Startups and small or medium-sized enterprises (SMEs) that are registered for corporate tax and comply with the prescribed filing deadlines

Under the latest UAE FTA update, eligibility for corporate tax penalty waiver can be verified on the FTA Website.

How to Become Eligible for a Corporate Tax Waiver in the UAE

To be eligible for a UAE corporate tax penalty waiver, businesses should ensure:-

- File the first corporate return within seven months following the end of the relevant tax period.

- The UAE FTA may waive late registration penalties if the first Corporate Tax return is filed on time, even when the tax registration was submitted late.

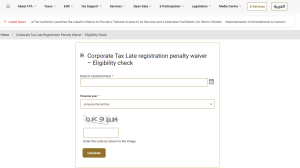

How to check eligibility for corporate tax waiver in the UAE

Businesses can early confirm the eligibility for corporate tax waiver using the UAE FTA’s digital tool.

To verify your eligibility:

- Visit the FTA portal: https://tax.gov.ae/en/ct.waiver.check.aspx

- Enter your establishment date: Mention your business incorporation date or the license issue date if the incorporation date is not available

- Choose the relevant tax period: select your business’s financial year from the drop-down

- Complete the Captcha: Complete the verification captcha and click on Calculate

Check your eligibility: The tool will instantly show if your business qualifies for the waiver and the deadline to comply.

Don’t Miss Out: Key Reasons This Update Matters for Your Business

This waiver is limited to businesses filing their initial corporate tax return; failing to meet the deadline can make you ineligible.

Benefits of acting without delay:

- Stay penalty-free by filing your corporate tax returns in the UAE on time

- Meet UAE Corporate Tax obligations on time

- Reduce exposure to financial and compliance risks

- Maintain full compliance and a clean FTA record

- Get expert guidance from the best corporate tax consultant in the UAE to ensure accurate filing and eligibility verification.

Action Plan for First-Time Corporate Tax Filers.

Haven’t registered for UAE corporate tax yet? Follow these steps to meet compliance requirements and stay compliant and penalty-free.

- Check your waiver eligibility using the FTA portal

- Ensure precise preparation of your corporate return to prevent mistakes

- File your first return on time within a seven-month window after your financial year ends

- Ensure financial records adhere to IFRS and FTA requirements

- Submit your return on time to qualify for an AED 10000 penalty waiver

- Get professional expertise from our corporate tax advisor in the UAE for any assistance

Act promptly to claim your Corporate Tax waiver: This FTA relief is available only if the deadline is met, and timely filing keeps your business compliant and penalty-free

Secure your UAE CT Penalty Waiver and compliance with JAXA Auditors.

The UAE FTA’s penalty waiver is a limited-time opportunity for businesses filing their first Corporate Tax return. To benefit, companies should check their eligibility, review their tax position, and act promptly.

With Jaxa Chartered Accountants, a UAE FTA tax agent with 18 years of experience in accounting, auditing, and taxation, businesses receive expert guidance on eligibility checks, accurate tax return filing, and proper financial record submission, ensuring full compliance and maximizing the relief.

Our team of highly qualified corporate tax consultants in the UAE provides end-to-end corporate tax compliance support.

Stay compliant and avoid penalties—verify eligibility and file on time with Jaxa, your trusted FTA tax advisor.