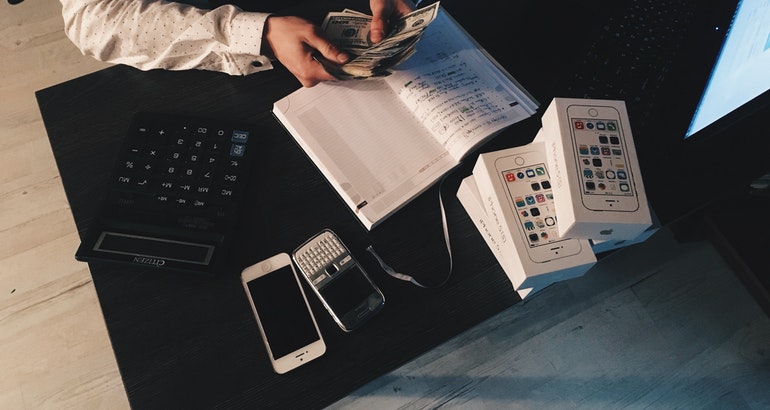

Time is money and investment is the new savings. Everyone needs to invest in having a secure financial future. The earlier you start investing, the higher the returns you get when you retire. Anyone can get into investing at any age, and it begins with creating an investment portfolio.

An Investment Portfolio

An investment portfolio is a set of assets owned by an individual or an institution. An investor’s portfolio can include real estate and so-called “hard” assets, such as gold bars. But most investment portfolios, particularly assembling portfolios to pay for retirement, are made up mainly of securities, such as stocks, bonds, mutual funds, money market funds, and exchange-traded funds.

The best retirement portfolios diversify the mix of investments — which can range from the caution of U.S. Treasury bonds to the risky zip of small-company stocks — to dampen market losses and maximize potential gains.

Having A Portfolio With Multiple Investment Records

ETFs & Mutual Funds

An effortless way to have multiple investments is by purchasing ETFs, index funds, or mutual funds. ETFs and mutual funds.

A properly diversified investment portfolio should include:

- Cash

- Stocks

- Bonds

- Exchange-traded funds

- Mutual funds

Diversify Individual types of Investments.

Pick investments with different rates of returns.

It is challenging buying individual stocks since you’ll need to invest a substantial amount to make the cost of the trading worthwhile.

So when investing in stocks, it is essential that you don’t concentrate on a single stock or a few stocks but a variety of stocks in different sectors. It’s also necessary to have stocks with multiple-incomes, growth, market capitalisation. When investing in bonds, consider bonds with various credits, durations, and maturity.

Investments with Changing Risks

Choose investments with a wide range of returns.

When diversifying your portfolio, pick investments whose rate of return is different to ensure substantial gains for certain investments offset losses in other assets.

Foreign stocks

Stocks from foreign countries tend to perform a little differently and typically balance out a domestic-heavy investment portfolio. You can also invest in small-cap or mid-cap stocks, which are younger, and more volatile in returns.

Rebalance your portfolio periodically.

Portfolio diversification isn’t a one-time task. Check your portfolio often and make changes when the risk isn’t consistent with your financial goals or strategy.